Bequest Through Your Will

A charitable bequest is one of the easiest ways you can leave a lasting impact on The Catholic Foundation of Northern Colorado. A bequest may be made in your will or trust directing a gift to The Catholic Foundation of Northern Colorado.

Benefits of Your Bequest

- Receive estate tax charitable deduction.

- Lessen the burden of taxes on your family.

- Leave a lasting legacy.

How Do You Make a Bequest?

A bequest is one of the easiest gifts to make. With the help of an advisor, you can include language in your will or trust specifying a gift to be made to family, friends or The Catholic Foundation of Northern Colorado as part of your estate plan.

Click Here to review sample bequest language.Your Bequest Options

A bequest may be made in several ways:

- Gift of a percentage of your estate

- Gift of a specific dollar amount or asset

- Gift from the balance or residue of your estate

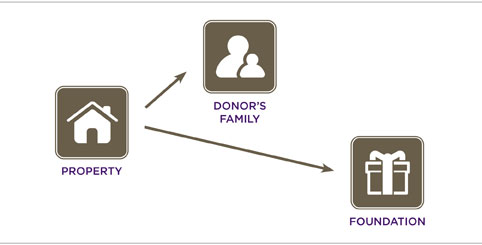

Making a Bequest of Your Retirement Assets

A retirement asset, such as an IRA account, makes an excellent bequest to us. If the IRA were given to your family, much of the value may be lost through estate and income taxes. By designating The Catholic Foundation of Northern Colorado as the beneficiary of all or part of your IRA (using a beneficiary designation form provided by your custodian), the full value of the gift is transferred tax-free at your death and your estate receives an estate tax charitable deduction.