Bargain Sale

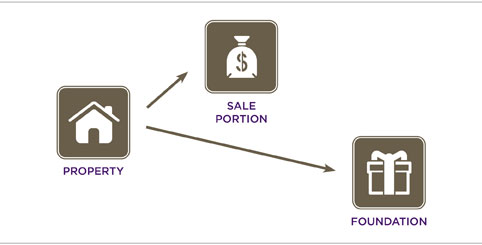

The Catholic Foundation of Northern Colorado purchases your property for less than fair market value. You receive the cash and a charitable deduction for the difference between the market value and purchase price.

How a Bargain Sale Works

- You sell The Catholic Foundation of Northern Colorado your property for a price less than fair market value.

- You receive the cash from the sale and a charitable deduction for your gift to The Catholic Foundation of Northern Colorado (the difference between the market value and purchase price).

- While you may owe some tax on the amount you receive from The Catholic Foundation of Northern Colorado, the charitable deduction from your gift could offset your taxes this year.

Benefits of a Bargain Sale

If you are considering selling your property, a bargain sale will help you meet all of your goals.

- Avoid capital gains tax on your charitable gift.

- The deduction from your gift will give you valuable tax savings that may reduce your tax bill this year.

- With the cash received from the sale, you may then reinvest to create more income for your future.

- Best of all, your gift will help The Catholic Foundation of Northern Colorado further its work.