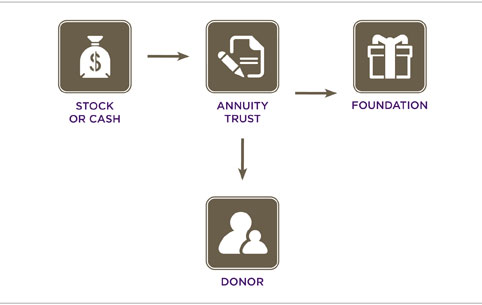

Charitable Annuity Trust

You may be concerned about the high cost of capital gains tax upon the sale of your appreciated property. Or perhaps you recently sold property and are looking for a way to save on taxes and plan for retirement. A charitable remainder annuity trust may offer the solutions you need.

Benefits of a Trust Gift

- Fixed income for life, lives or term of years

- Avoid capital gains tax on the sale of your appreciated assets

- Charitable income tax deduction for remainder portion of your gift to The Catholic Foundation of Northern Colorado

Charitable Remainder Annuity Trust for Fixed Income

If you are tired of riding the fluctuating stock market and want a fixed income, a charitable remainder annuity trust may provide you with the stability you desire. A charitable remainder annuity trust pays out a fixed amount each year based on the value of the property at the time it is gifted.